How does a “surefire track” to financial success sound?

There is NO one size fits all plan. Our team has the combined knowledge and experience of 65+ years enabling us to work up creative strategies and solutions allowing you to reach your financial dreams. We get to know you on a personal level, develop a meaningful relationship and inspire you to live the life you’ve always wanted.

How has the SECURE Act changed financial planning?

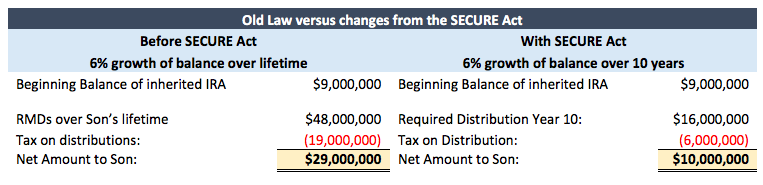

The SECURE (Setting Every Community Up for Retirement Enhancement) Act of 2019 enacted by Donald Trump changed a few things. One major change includes the elimination of the stretch provision. Previously, inherited qualified retirement accounts such as 401(k)’s, IRA’s, 403(b)’s, 457 plans could be passed down to non-spousal beneficiaries who could then spread out the tax burden across their entire lifespan. Now, these non-spousal beneficiaries are under a 10-year liquidation deadline. Growth is hindered due to the loss of time to grow and compound and the tax burden is greater due to the shorter liquidation window.